Extended Producer Responsibility (EPR) is a strategy adopted by many governments to ensure that producers are responsible for the products and packaging they place on the market through to, and including, disposal and waste management / recycling.

This is not a new strategy, the concept of EPR was first implemented in Germany in 1991 which resulted in significant progress in recovery and recycling rates. Following this success, the same methodology has been / is being implemented across many European countries, North America and Asia with varying levels of eco-modulation.

The challenge is that each EPR scheme differs in fee structures, rule sets, obligated companies and data submission periods (annual, 6 monthly, quarterly and monthly) which makes it incredibly difficult for brands and retailers selling in multiple countries or importing / exporting product and packaging to remain compliant. All existing EPR schemes require detailed packaging data, some of which have standard fees for all base material groups such as plastic, glass, metal, etc whilst others have varying levels of eco-modulation. Some have lower fees for recyclable packaging by base material, others by base material, colour and recycled content.

Good EPR schemes

- Are clear and coherent, with clear roles, responsibilities, outcomes and targets, and work coherently with other policies, including wider waste policies

- Are catalysts to encourage design for recyclability either through eco-modulation of fees or incentivising schemes such as bonus or refund models

- Cover the full net costs (FNC) for end-of-life of packaging that is placed into the market

- Ensure compliance of all obligated organisations

- Are easy for consumers to understand, with clear and consistent labelling of what can and cannot be recycled

Who is affected?

Obligated companies differ considerably by country / state.

For example, in the UK, EPR is applicable to businesses (not charities) that have a turnover of £1 million or more, or place more than 25 tonnes of packaging on the UK market. This includes supply of packaging goods to the UK market under the business’ own brand, importers of products in packaging and online marketplace owners. Currently with the existing PRN scheme, fees are shared proportionally between retailers, product manufacturers, packaging converters and raw material providers. With EPR there is a list of activities that define obligated businesses, however even if your business is not obligated to pay the fees it will still have to collect and report packaging data.

Compared to EPR in France where there is no minimum amount of packaging material or turnover limit. France’s EPR applies to producers, retailers, or bottlers with a registered office in France. This includes importees who sell directly to French end users. Therefore, if you sell one product you are obligated to pay EPR fees.

In most countries there is a de minimis however, as with the example of France, do not assume you will fall over the threshold – know your responsibilities as the fines can be considerable.

When?

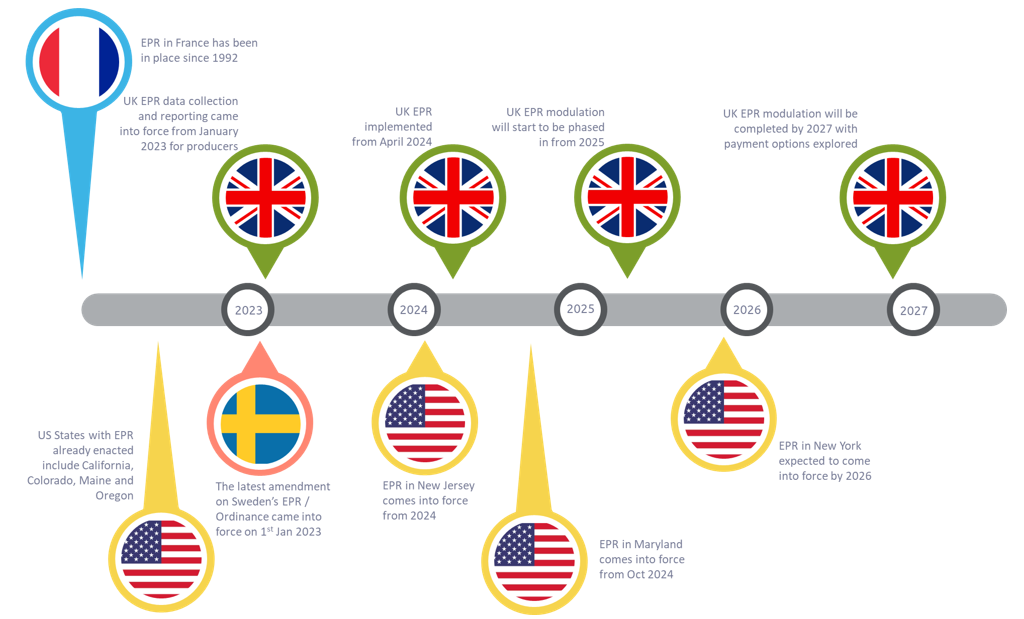

Each market also has different implementation timelines and data submissions – know your market requirements and manage them proactively.

How much should be budgeted?

For UK organisations moving from PRNs to EPR a good rule of thumb would be 4 times current taxes when EPR is introduced in 2024, this will then likely increase to 10 times current taxes when eco-modulation is fully implemented by 2027.

Gillian Garside-Wight

If you are currently placing product and packaging in a country which is planning on implementing EPR, please do not wait. Proactively manage budgets by selecting packaging formats, materials, colours that attract the lowest possible EPR fees by country / state.

If you are placing product and packaging on the market of a country with implemented EPR then budgets can be easily calculated. However, if the country is in the process of planning or implementing EPR then it is highly likely going to have a significant impact financially.

For UK organisations moving from PRNs to EPR a good rule of thumb would be 4 times current taxes when EPR is introduced in 2024. This will then likely increase to 10 times current taxes when eco-modulation is fully implemented by 2027. However, this is only part of the financial impact, the resource required to facilitate this whole process should not be underestimated. From initial research to data collection and cleansing through to the submission as well as the continual evaluation of any changes required for future submission all comes at the cost of resource.

Total Cost of Goods (TCG) has never been as important as it is today… know your costs.

At Aura we help organizations collate and understand their data in real time. This allows them to manage sustainability everyday, and adjust their packaging as needed to better manage EPR commitments.

Contact us for more information on how we can help your organisation manage sustainability everyday.